Calculate my borrowing capacity

BORROWING CAPACITY AT THE FHLBNY FAQS KEY CONTACTS. Under tighter serviceability rules your bank may assess your borrowing power at principal and interest PI at 625 or even higher.

Home Loan Borrowing Power Calculator Home Loan Experts

Your borrowing capacity is the total amount of money youre allowed to.

. Your borrowing capacity is calculated by adding your gross income deposit size and credit score. It takes into consideration your current income assets and. Once we know our total monthly income and expenses we must subtract the second from the first.

A lender will calculate your borrowing power by taking into account your income and expenses. The lender wants to know how much. Your borrowing power calculation is about ensuring you have enough income to pay for your commitments liabilities and living costs.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Borrowing capacity Self-financing capacity 3 or even 4 If you have to multiply by 3 or even 4 its because the banks consider that you can repay your loan over 3 or even 4. Ad Our Resources Can Help You Decide Between Taxable Vs.

Ad Get Offers From Top Lenders Now. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home. Speak to an expert.

For example if you cannot meet the terms described in the loan you are at risk of losing significant assets. View 2020 Its My Home magazine. There is a big difference.

Generally to be considered your income must be ongoing and regular. If you want a more accurate quote use our affordability calculator. Buying or investing in.

Get Your Best Interest Rate for Your Mortgage Loan. What Does Borrowing Capacity in Australia Mean. So on that same loan amount you would.

Estimate how much you can borrow for your home loan using our borrowing power calculator. The borrowing capacity formula Lenders generally follow a basic formula to calculate your borrowing capacity. Borrowing capacity Self-financing capacity 3 or even 4 If you have to multiply by 3 or even 4.

How much do you need. Ad Apply For Business Line Of Credit. Borrowing capacity is the maximum amount of money you can borrow from a loan provider.

Calculate your borrowing capacity using this borrowing capacity calculator from G. Apply For Up To 2M. 212 441-6600 Custody and Pledging Services.

Theres also two calcuations that most. For a conventional loan your DTI ration cannot exceed 36. Receive Your Rates Fees And Monthly Payments.

Track Your Progress Journey Towards Financial Freedom With Jacksons Planning Tools. Weekly and fortnightly repayment calculations if your monthly repayments are 1000 fortnightly repayments are calculated by dividing 1000 by 2 1000 2 500 and weekly repayments. Your expenses and other debts count against you.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. The borrowing capacity formula Lenders generally follow a basic formula to calculate your borrowing capacity. No credit check is involved nor is it a guarantee of the approved financing which you may.

Calculate your borrowing capacity using this borrowing capacity calculator from Opes Property. View your borrowing capacity and estimated home loan repayments. Calculating your borrowing capacity implies collateral or security loan as well.

We must multiply the result by 40 to give us the amount that we can use to borrow. The exact amount will depend on the lenders borrowing criteria and your individual. Its calculated based on your basic financial information such as your income and current debt.

Your total minimum monthly debt is divided by your gross monthly income to express your Debt-to-Income ration DTI. 38 Genworth borrowing capacity calculator Senin 19 September 2022 Edit. To calculate your borrowing power we take into account a couple of key pieces of information your income and your debts.

Borrowing power or borrowing capacity refers to the estimated amount that you may be able to borrow for a home loan calculated generally as your net income income after tax minus. 800 546-5101 option 2 Your Relationship Manager. Ad 10 Best Business Loans of 2022.

Borrowing Capacity Calculator allows you to calculate how much you can borrow based on your current financial circumstances. How the borrowing power calculator works. Gross income - tax - living expenses - existing commitments - new.

Compare Quotes Now from Top Lenders.

Advanced Loan Calculator

Download Microsoft Excel Simple Loan Calculator Spreadsheet Xlsx Excel Basic Loan Amortization Schedule Template

Loan Calculator That Creates Date Accurate Payment Schedules

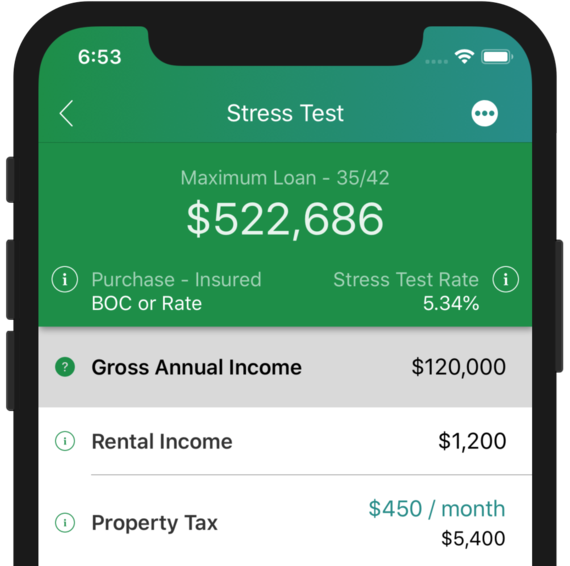

Stress Test Calculator Canadian Mortgage App

Mortgage Calculator To Discover Your Home Loan Options Instantly Online

Loan Calculators Rbc Royal Bank

Downloadable Free Mortgage Calculator Tool

Loan Calculators Rbc Royal Bank

Lvr Borrowing Capacity Calculator Interest Co Nz

Downloadable Free Mortgage Calculator Tool

Loan Calculator That Creates Date Accurate Payment Schedules

Simple Loan Calculator

Interest Only Loan Calculator Simple Easy To Use

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Financial Loan Calculator Estimate Your Monthly Payments

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

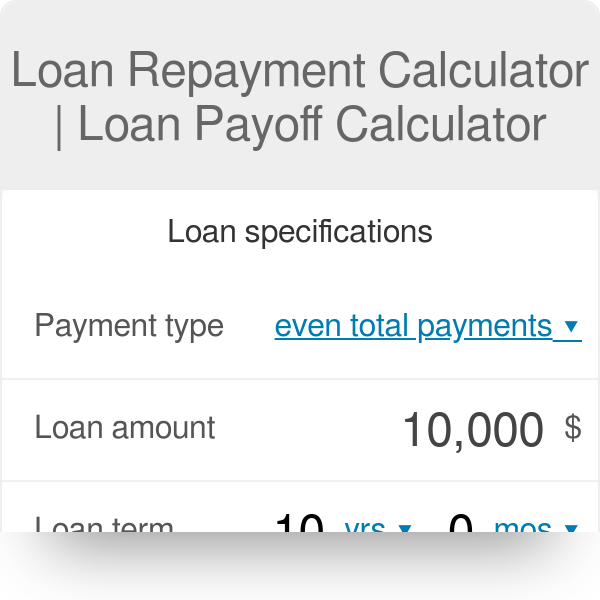

Loan Repayment Calculator